elPrgMethodology

Last modified in version : -

Purpose : retrieve the parameters and bounds to which each portfolio models have been calibrated upon.

Summary

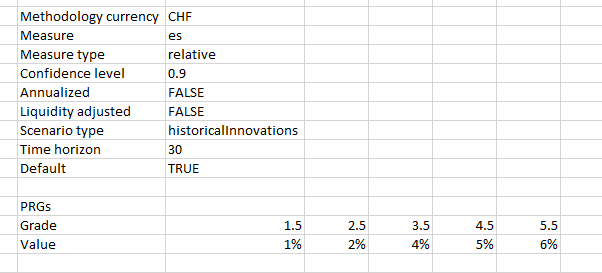

The elPrgMethodology function returns 3 types of output. If no parameters are inserted, the output will be the currencies upon which your portfolio models are calibrated. If only “MethodologyCurrency” is specified, you’ll get the summarized view, namely a table with the PRG levels and their bounds (“Value”). Finally, if you set to TRUE “ShowDetails”, in addition to the PRG levels and values, you’ll have a view on the different parameters used during the calibration (e.g. confidence level, time horizon etc.)

Examples

=elPrgMethodology("USD", TRUE)

Retrieves the parameters used in the PRG calibration and the bounds of the portfolio models. The parameters are the currency, the risk measure, the measure type (relative or absolute) the confidence level, annualized, liquidity adjusted, the scenario type (“historicalInnovations” or “historicalReturns”), the time horizon and default. If default is FALSE, then the currency inserted in “MethodologyCurrency” is not the fallback currency, or else it is. A fallback currency is unique and is the reference currency for any portfolio that is based on a currency that is not part of the PRG calibration. The parameter liquidity adjusted is boolean. If it is True, it means the PRG calibration and computation account for the liquidity risk of the portfolio’s positions.

Syntax

elPrgMethodology(MethodologyCurrency, ShowDetails)

| Argument name | Description |

|---|---|

| MethodologyCurrency | Any currency that have been used in the calibration. Type =elPrgMethodology() in a cell to see the list of available currencies. |

| ShowDetails | Boolean, if set to TRUE, the parameters used in the calibration are shown, or else only the PRG levels and bounds are displayed. |