elRiskFactorExposureAggregate

Last modified in version : -

Purpose : retrieve the risk factor values (aggregated by group of risk factors) impacting the valuation of the position

Summary

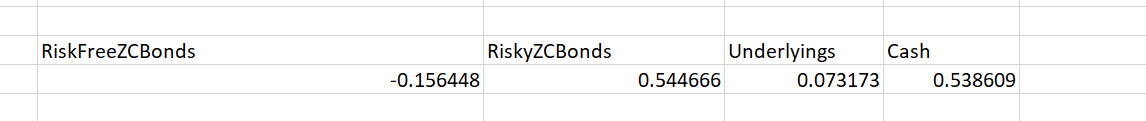

The elRiskFactorExposureAggregate function displays the value (aggregated) of each of the risk factor buckets namely - RiskFreeZCBonds, RiskyZCBonds, Underlyings, Cash. The sum of these values equals 1 which is the normalized valuation of the position’s value. These exposures result from the breakdown that is the equivalent valuation of a position into its risk factors (sources of risk). RiskFreeZCBonds and RiskyZCBonds reflect the interest rate and issuer’s risky rate dependency while underlyings reflect the dependence on the underlyings’ spots and implied volatilities (in the case of options for instance).

Examples

Let’s take the example of the BRC CH0579768547.

=elRiskFactorExposureAggregate("positions",CH0579768547,1,"CHF",TRUE)

Below is the raw output of calling the above function. Of course the output can be formated.

In this case, the conclusion is that the main the valuation’s driver are the RiskyZCBonds (the issuer) and the Cash risk factors. It is expected as this BRC has experienced no “barrier-event”.

In this case, the conclusion is that the main the valuation’s driver are the RiskyZCBonds (the issuer) and the Cash risk factors. It is expected as this BRC has experienced no “barrier-event”.

Syntax

elRiskFactorExposureAggregate(CalculationsLevel, AssetIDs[], Quantities[], Currency, HeaderRow)

| Argument name | Default | Description |

|---|---|---|

| CalculationsLevel | The granularity at which the results should be calculated (individual asset, portfolio). | |

| AssetIDs | Single or multiple asset identifiers (ISIN, FIGI, currency ISO, Edgelab ID). | |

| Quantities | Asset quantities in the same orders as the specified asset ids. | |

| Currency | The ISO code of the reference currency for deriving the calculation results. Specify “local” to use the instruments native currency where appropriate. It is mandatory to specify a currency when the granularity is “portfolio”. | |

| HeaderRow (Optional) | False | Boolean. If true, the headers are displayed, if false, they are not. |